Student loans. Mortgages and automobiles. Savings. Debt. Money is something that can quickly become disorganized if you let it.

Have you ever wished you could see your entire financial picture in one place? You can.

A personal balance sheet can make all the difference if you’re confused about where your money is going, what you owe, or what your net worth is. You can set it up and keep track of it to always have a good idea of your money situation.

If you’re tired of guessing about finance and want a clear understanding of what steps you should take with money, check out these ideas about a personal balance sheet.

What is a Personal Balance Sheet?

Before reading any further, what is a personal balance sheet? How does it help you with your finances?

A personal balance sheet is a look at your liabilities and assets, and it shows you what your net worth is. This helps you know exactly where you’re at financially, making budgeting, saving, and debt payoff easier.

You can use any type of spreadsheet like Google Sheets or Excel to make this more manageable if you want.

Plus, it will give you access to it through electronic devices like your laptop or phone if needed. Using a sheet of some sort will allow you to see your whole financial picture clearly and in one place.

Why Create a Personal Balance Sheet in the First Place?

Maybe you’re wondering why all of this is so important. What does having a personal balance sheet really accomplish?

First of all, it tells you your net worth. When you calculate all of your assets minus all your liabilities, you are left with your net worth.

Your net worth can be a negative or a positive number depending on your debts. However, it is still a great idea to know this information.

The other great thing about a personal balance sheet is it allows you to see if you’re meeting your financial goals over time.

Because you can make this sheet and then update it over weeks and months, you can see if you’re getting closer to the things you want to accomplish with your money. This might be buying a new car, paying off a loan, or saving an emergency fund, but this sheet lets you know by looking at the numbers whether you are going in the right direction or not.

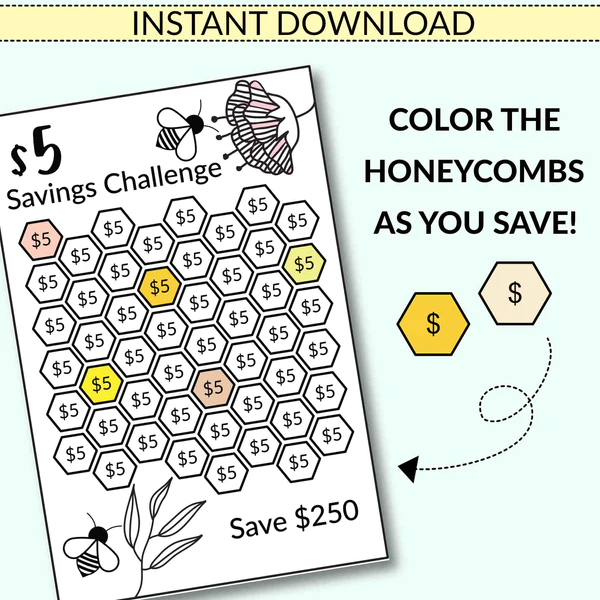

For keeping track of individual savings goals and sinking funds, check out these savings challenges!

How Do You Create a Personal Balance Sheet?

You’ll need to start with some research into your assets and liabilities. Begin by writing down every asset you have and how much it’s worth.

Don’t leave out anything, and be sure to be as detailed as possible with the amounts, even if it takes a few hours or so to find the information. Then add them all up in a grand total.

Next, you need to find and write down all of your liabilities and debts. Then add how much you owe for each item.

Add all of what you owe together. Be sure to include everything you can think of that qualifies for this category, so you can get the best information for your personal balance sheet.

After you have found all this information, take the two grand totals and subtract your liabilities amount from the amount of your assets. This will give you the magic number you’ve been looking for: your net worth.

Your net worth is the actual amount of money you have. As an example, suppose you have $100,000 in assets and $90,000 in liabilities, your net worth is $10,000.

Your net worth tells you how much you’d have left if you had to pay off every debt and sell every asset today.

You can also go into the negative in your net worth. For instance, if you have $50,000 in assets and $70,000 in liabilities, then your net worth is -$20,000.

Having a negative net worth is not a good place to be, but the great news is you can get past it. You need all the information possible when it comes to finances. That way, you can make an action plan and quickly get to work on anything that doesn’t line up with what you want financially.

What Should Be Included in a Personal Balance Sheet?

All Assets

The first thing to include in your personal balance sheet is every asset you own. But what are assets? Here’s a list to help you decide.

1. Cash

Cash means the money in your checking and savings accounts and any other cash that you have. This all represents positive net worth and should be considered an asset.

2. Property

Property like land is very valuable, mainly if you resell it for a large profit. This makes any property that you own an asset. This can include expensive artwork, jewelry, land, some vehicles, and more.

3. Investments

Any investments are considered assets because you can sell them. These should be added to your balance sheet.

4. Patents

If you’ve patented anything, this is considered an asset as it has the potential to make money in the future.

5. A paid-off house

A home with no mortgage is an asset. You can sell it for a significant profit if you want to.

While this isn’t directly related, it provides you with a place to live free of charge, increasing your ability to acquire more assets.

You should remember that while these things are considered assets, this list is not comprehensive. Other things might be regarded as assets as well, provided they have value and can help you economically.

All Liabilities

Your liabilities are debts and things that you owe to someone. They create a negative value in your net worth and, for the most part, should be avoided if possible.

Here’s a list of the liabilities you should add to your personal balance sheet:

1. Credit Cards

A credit card with a balance is considered a liability because you must pay back the money. While all credit cards are not bad, carrying debt on them will not help you financially.

2. Student loans

Student loans need to be paid back and they collect interest. While it can help you pay for college, it comes at a high, and usually more expensive, price. This should be included on your balance sheet.

3. Mortgages

A mortgage is a loan for your house. It is considered a liability, but it becomes an asset when you pay off your home.

4. Car loans

These debts have to be paid before you own your car outright, and they are generally avoidable.

5. Any debt you owe

Anything else you owe money for or anything that could create a negative value in net worth is considered a liability.

How Can a Personal Balance Sheet Help You Manage Your Finances?

You should make your own personal balance sheet for a couple of important reasons. It’s a great way to outline your finances by getting a snapshot of your net worth that you can use in the future.

If you know where you are now, it can help you later. And once you know your financial situation, you can begin thinking about your money.

This allows you to set goals for the future and decide what you will do. Without the information a personal balance sheet gives, you may be trying to make financial decisions without having the whole picture.

How to Make a Financial Plan After Making Your Personal Balance Sheet

Once you have a balance sheet that shows you your net worth, how do you make a financial plan? What are the main things to remember, and what are the step-by-step instructions to get the most you can out of your balance sheet? Here’s how to start:

Set Your Goals

Once you can see your whole financial picture, you’ll be able to set your goals. There are a few directions to go, depending on what your net worth looks like.

If your net worth is negative: Find out exactly how much money you must pay off to get your net worth to zero.

Use these debt tracking and payoff printables to help you reach your debt-free goals.

Your plan should include paying off your debts and liabilities as soon as possible while also paying your bills and saving for retirement. You might consider working an extra job or finding some way to pay off your debt faster if there’s a lot of it.

If your net worth is positive but not by much: If you are on the positive net worth side but don’t have much money, it’s a good idea to start thinking long-term with your finances. Start adding to your savings and make a plan to acquire assets when you can.

If your net worth is positive with plenty of assets, you’re doing great if this is your situation! Consider what you most want to do with your money, and buy assets that fit with that. Be sure to keep a healthy amount of savings and continue investing for retirement, too.

Make a budget

After setting your goals, you can make them more manageable by creating a budget. A budget is like a small goal each week or month that allows you to make progress towards your bigger goals.

Be sure to include expenses, debt payoff, savings, and money to acquire assets as you can. You can save up and spread this out over a period of time, like months or years.

Your budget should fit your lifestyle and make sense to you. Don’t try to make one that’s too hard to stick with. Instead, find something that works with your values and allows you to do the things you want to with money.

You can use these free monthly budget worksheets to keep you on track.

Related: 9 Best Personal Budgets to Choose From

Make a long term savings plan

After you save up an emergency fund, it’s a good idea to decide how you want to save money long term. It’s essential to save for a lot of reasons, from needing to replace a roof to paying for a car or buying investments.

Some people use a percentage method for saving, like 10%. Others prefer to save a flat rate every month or year.

Or maybe you want to save an entire income if you are a two-income household. Find out what works for you and start saving!

Keep working towards your dreams

Once you know your net worth, goals, and have a budget and savings plan, keep going! Continue to update your personal balance sheet, get rid of liabilities, and build up your assets so you can thrive financially.

There are many ways to stay inspired to reach your financial goals. You can try writing down your goals and dreams to make them more detailed. Another idea is to reward yourself on occasion when you stick to your budget. Do whatever helps you succeed.

Creating a personal balance sheet gives a clear view of your finances and net worth for financial planning.

Your personal balance sheet may be one of the smartest things you can do for your financial present and future. It lets you know where you’re at, whether you’re going in the right direction, and if you need to turn around and try something different.

You can even update your personal balance sheet to include your future goals and see what it will take to reach them. It’s a great way to find out everything you consider an asset and total up all of your debts and decide how to pay them off.

It can also help you make a budget, set goals, save money, and more. Plus, it will give you clarity and make it impossible to ignore any financial situations you should deal with.

When you have a personal balance sheet and can constantly update it, you will always know the big picture for your money. This makes it easy to make financial decisions and plan for the future.

If you’ve never created a personal balance sheet, why not start today? Even if it takes a while to add up everything and find all the information, you’ll be glad you did. It will save you time and maybe even money later.

Related Articles: