Now, more than ever, Canadians are struggling with the high cost of real estate nationwide. As of 2023, well over 5 million Canadians are renting as housing prices continue to climb.

Whether you rent or buy, the property and your belongings should be protected by insurance. For renters, there is tenant insurance, which offers the same protection for your personal property as homeowner’s insurance does.

As the largest bank in Canada, RBC offers tenant insurance to millions of renters across the country. This article will review everything you need to know about RBC tenant insurance, including its features, coverage, and whether you even need it as a renter in Canada.

What is Tenant Insurance?

Tenant insurance is a type of insurance that protects renters against damage or loss of their personal property in their rented residence.

While you might not own the property you live in, you are still entitled to keep your belongings safe in case of an accident. It can also protect your belongings outside of the home and cover additional costs like moving costs or a hotel if you cannot stay at your residence.

Tenant insurance is also referred to as renter’s insurance and is recommended, although not mandatory, for renters in Canada.

How Tenant Insurance Works

Tenant insurance works very much like any other insurance policy: you will pay a monthly or annual premium in exchange for coverage and protection of your belongings.

In the event you have to make an insurance claim, you will pay the deductible, and the insurance company will cover the rest.

What does tenant insurance cover?

- Personal Belongings/Contents

- Living expenses if your residence is no longer inhabitable

- Liability claims if you accidentally cause damage to another residence or person

RBC tenant insurance covers the replacement value of your personal belongings. The policy’s premium is based on things like the total value of your belongings as well as the size, age, location, and construction of your residence.

Do You Need Tenant Insurance?

Tenant insurance is not mandatory for renters in Canada. It is, however, recommended as a way to protect your belongings. Tenant insurance is also essential if something that is out of your control happens to your residence.

If you live in an apartment building, your residence can be impacted by any of your surrounding neighbours. Not only will tenant insurance replace any of your possessions that are damaged, but it will cover the cost of your living expenses if you have to live elsewhere.

Unless you have the cash to replace all of your belongings if they were suddenly gone, tenant insurance is a good idea if you are renting in Canada.

RBC Tenant Insurance Features

RBC is the largest bank in Canada and one of the largest in the world. It should come as no surprise that it offers extensive tenant insurance coverage for Canadian renters.

This tenant insurance covers all of the usual things like replacing your belongings, covering your living expenses, and a nice range of liability coverage. But RBC tenant insurance also offers coverage on things like damaged property in your vehicle and your personal property while you are away from your residence.

RBC Tenant Insurance Coverage

RBC’s tenant insurance has an impressive list of things covered under their policies. Here is a detailed look at RBC’s tenant insurance coverage:

| RBC Tenant Insurance Coverage Type | RBC Tenant Insurance Plan Details |

| Personal Belongings/Contents | RBC tenant insurance has your bases covered with All Perils Coverage |

| Special limits on some belongings | Special Coverage Limits – Property Insurance |

| Non-owned property | Covered |

| Personal property at other location | Covered (while temporarily away from home) |

| Property in your vehicle | Covered for up to 100% of Contents Coverage |

| Additional living expenses | Covered for up to 40% of Contents Coverage |

| Liability coverage | $1 million to $2 million |

| Voluntary medical payments | $5,000 |

| Voluntary property damage | $1,000 |

| Extensions of Coverage | Extensions of Coverage – Property Insurance |

| Optional endorsements | Endorsements for Your Property – RBC Insurance |

| Deductible | $1,000 or more |

| Deductible waiver | Yes, if the claim is for more than $25,000 |

RBC tenant insurance does not normally cover water damage from flooding or seepage. If you want to beef up your RBC tenant insurance policy, you can add additional endorsements like sewer backup, overland water, and earthquake coverage.

Cost of RBC Tenant Insurance

The cost of RBC tenant insurance will depend on several factors. These include but are not limited to:

- The age, price, location, and construction of your residence

- The value of your possessions

- Personal liability limit

- Deductible amount

- Added endorsements or additional coverage

- The type of heating in your home

- How close it is to a fire hydrant

- Your credit score

Let’s look at an example of RBC tenant insurance for a standard renter scenario:

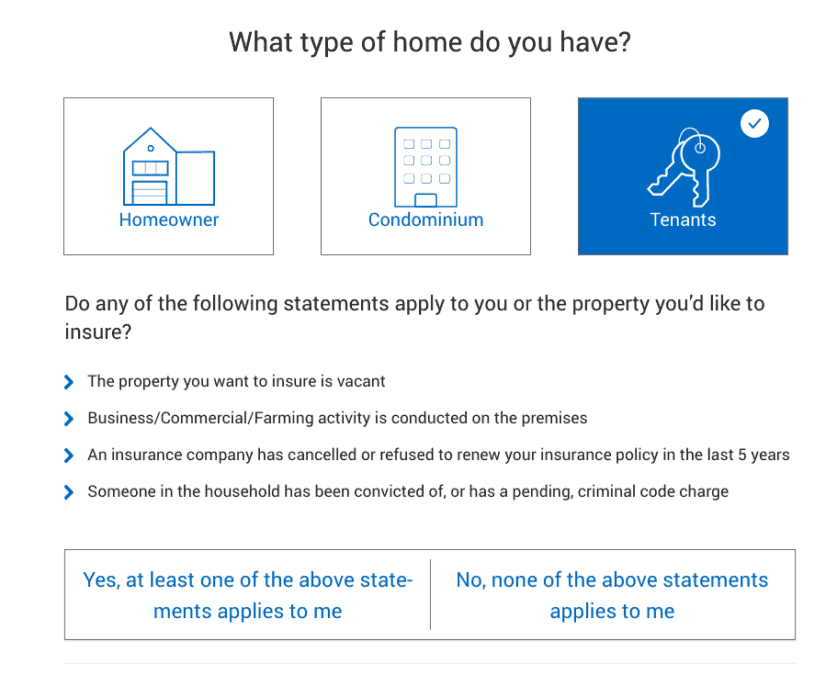

You will be asked a number of questions to set up your tenant insurance application.

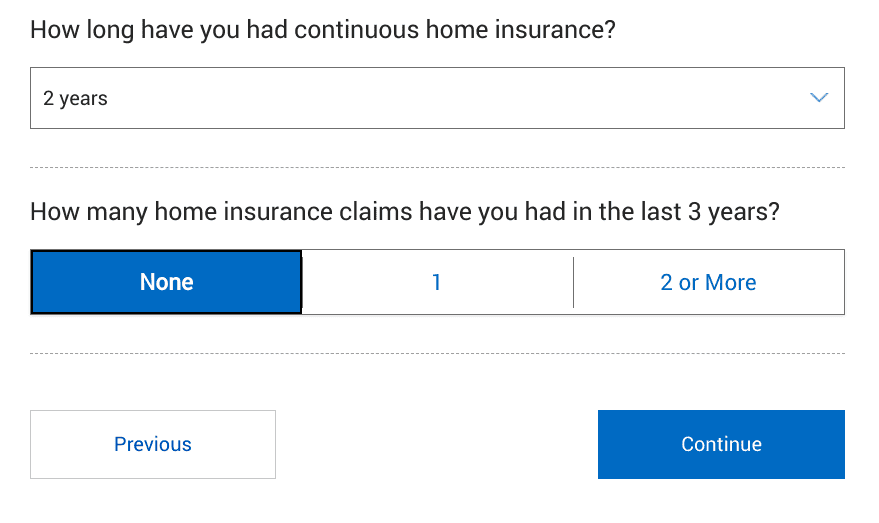

RBC will then ask you about your current and previous living situations and if you have had any type of tenant or homeowner’s insurance previously.

Step 1 of the actual application is Property Details. Here you will enter the age, type of residence, exterior wall construction material, primary heating device, and distance to a fire hydrant.

This step will also ask you the value of your possessions, ranging from $30,000 to $100,000.

For this example, we used a detached home built in the late 1980s with $50,000 of contents to be insured. We also chose a stucco exterior with a hot water boiler with natural gas.

Step 2 will ask about your personal information, including your name, email address, and phone number. RBC will also ask for your permission to run a credit check. Nothing unusual on this page, although it will ask you about your recent tenant insurance history:

With a personal liability of $1 million and no earthquake or sewer coverage, the RBC tenant insurance policy comes out to a reasonable price of $346.00 per year or $28.83 per month.

How to Apply for RBC Tenant Insurance

Applying for RBC tenant insurance is a simple process that only takes a few minutes to receive a quote online. If interested, check out the application process on their website, or call RBC’s customer support line at 1-877-737-7224.

Note that you cannot buy RBC tenant insurance online. You will need to call the above RBC support line or head into a branch to meet with an RBC insurance advisor.

Advantages of RBC Tenant Insurance

In Canada, there is always an advantage to using a big bank for services like insurance. RBC offers a wider range of coverage than most other insurance companies.

RBC tenant insurance even covers your belongings while on vacation or if they are in your vehicle.

While it might not be the cheapest tenant insurance in Canada, RBC provides very competitive and reasonable prices for its policies.

Downsides of RBC Tenant Insurance

You cannot buy the insurance online at RBC; you need to go through an agent or head into a branch to get your policy.

Incidents, like sewer backup, are optional, whereas they are included in many other tenant insurance policies in Canada.

RBC tenant insurance does not cover unit improvements and requires you to update your policy.

Is RBC Tenant Insurance Worth It?

RBC tenant insurance is definitely worth it if you are a renter in Canada. This insurance policy has extensive coverage, and our example scenario came in at a reasonable $28.83 per month.

No doubt, you can find cheaper tenant insurance policies in Canada, but they will likely not have the same extensive coverage that RBC provides.

If you want the convenience and reliability of a big bank with excellent coverage, RBC tenant insurance is the perfect way to protect your belongings from being lost forever.

FAQs

RBC insurance policies for homes and vehicles are now provided by Aviva Canada. You are still purchasing the policy through RBC, but the coverage itself is through Aviva.

Tenant insurance prices in Canada will depend on where in the country you live. Prices can range from just over $10 per month to more than $30, depending on your policy. Tenant insurance is much cheaper than homeowner’s insurance in Canada.

No, tenant insurance is not mandatory for Canadian renters. It is recommended if you cannot cover the cost of all of your possessions.

Landlord insurance is not mandatory in Canada, although, like tenant insurance, it is recommended. This type of insurance can cover things like rental income if your rental property is uninhabitable for a period of time.

Related:

- How Does Mortgage Insurance Work?

- Pros and Cons of Employer-Provided Life Insurance in Canada

- How Does Group Life Insurance Work?